Breaking News

Popular News

Chinese startups are reshaping the global economy. Discover success stories, innovations, and venture capital growth in China in 2025.

Chinese startups are rapidly becoming key players in the global economy, introducing breakthrough technologies, products, and business models. Over the past decade, China has emerged as one of the largest hubs for venture capital. According to the Hurun Research Institute, in 2024 over 1,200 Chinese startups secured investments exceeding $1 million, with total venture capital surpassing $70 billion, a 15% increase from 2023.

These companies span technology, fintech, AI, biomedicine, and electric vehicles. Their success stems from China’s 1.4 billion-strong domestic market and strong government support through tax incentives, grants, and accelerator programs.

Initially a small battery manufacturer, BYD has become a global EV leader. In 2024, the company sold 3.2 million electric vehicles, surpassing Tesla in global volume. BYD combines advanced battery technology with proprietary vehicle software.

Founded in 2006, DJI dominates the global consumer drone market, controlling 70% of worldwide sales and supplying products to over 100 countries.

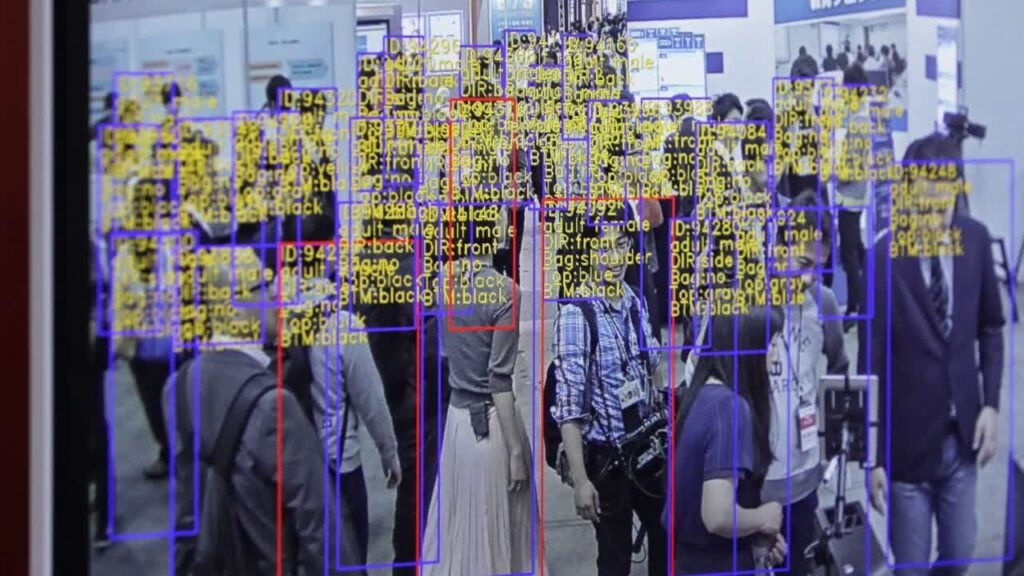

A leading AI company specializing in facial recognition and video analytics, SenseTime raised $1.5 billion in 2024 to expand into Europe and Latin America.

These examples highlight how Chinese startups scale from domestic operations to global influence, transforming industries worldwide.

Chinese startups lead in fintech innovation. According to CNNIC, over 1 billion Chinese citizens use mobile payments, with companies like Ant Group and Lufax offering low-cost lending, insurance, and investment solutions.

Innovations include:

McKinsey projects that by 2030, Chinese fintech startups could capture up to 20% of the global digital finance market, presenting major opportunities for international investors.

China’s AI startups attract global attention due to data access and cutting-edge technology. In 2024, investments in AI ventures reached $12 billion, spanning healthcare, autonomous vehicles, and industrial automation.

Key players:

These companies position China as a global AI innovation leader.

China actively supports startups. In 2024, over $5 billion in grants and subsidies were allocated to technology ventures, complemented by innovation hubs in Shenzhen, Beijing, and Shanghai.

Investors see this as a unique opportunity: China’s venture market offers 15–20% average annual returns and strong potential for global market expansion.

1. What are Chinese startups?

Emerging companies in China introducing innovations in technology, fintech, AI, EVs, and other sectors.

2. Why are they successful?

Large domestic market, government support, venture capital, and cutting-edge technology.

3. Which companies are leading the market?

BYD, DJI, SenseTime, Ant Group, Lufax, Megvii, Horizon Robotics.

4. Which sectors are most promising?

Electric vehicles, AI, fintech, biomedicine, and digital platforms.

5. Can investors participate?

Yes, China’s venture market attracts international investors with 15–20% returns and global growth opportunities.